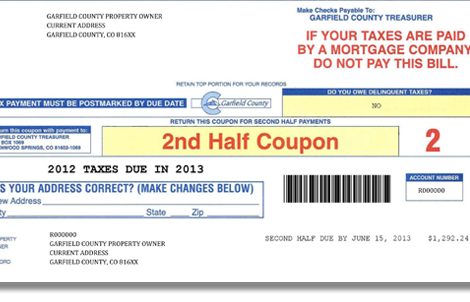

Delay in property tax notice mailing

Garfield County property tax notices are delayed in mailing with the application of a new dual assessment rate calculation method. While tax bills are generally in the mail on or before January 30, there is a slight delay in the mailing of the 2025 notices (payable in 2026). House Bill 24B-1001 and Senate Bill 24-233 created a bifurcated assessment rate for residential property. This means for 2025, the school district assessment rate is 7.05 percent, while other taxing authorities are assessed at 6.25 percent. Garfield County’s software is encountering significant issues and delays with the two-method calculation used to create